401k distribution tax calculator

The IRS generally requires automatic withholding of 20 of a 401 k early withdrawal for taxes. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½.

. Even without matching the 401k can still make financial sense because of its tax benefits. Compare 2022s Best Gold IRAs from Top Providers. With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Retirement planner Retirement pension planner. 401 k distribution tax form.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Using this 401k early withdrawal calculator is easy.

Required Minimum Distribution Calculator. This tax form shows how much you withdrew overall and the 20. Making Your Search Easier.

IRA minimum withdrawal calculator. If you dont have data ready. And from then on.

The tax treatment of 401 k distributions depends on the type of plan. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. The IRS regulations in the United States state.

Ad Learn More About American Funds Objective-Based Approach to Investing. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator.

Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important. If you withdraw money from your. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Ad Find 401k Tax Calculator Withdrawal. In this case your withdrawal is subject to the.

Only distributions are taxed as ordinary income in retirement during which retirees most likely fall within a lower tax bracket. Reviews Trusted by Over 20000000. Traditional 401 k withdrawals are taxed at an individuals current income tax rate.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. DistributeResultsFast Can Help You Find Multiples Results Within Seconds. In general contributions to retirement accounts can be made pre-tax as in.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. That extra 6000 basically makes the calculation a no-brainer. Ad Use This Calculator to Determine Your Required Minimum Distribution.

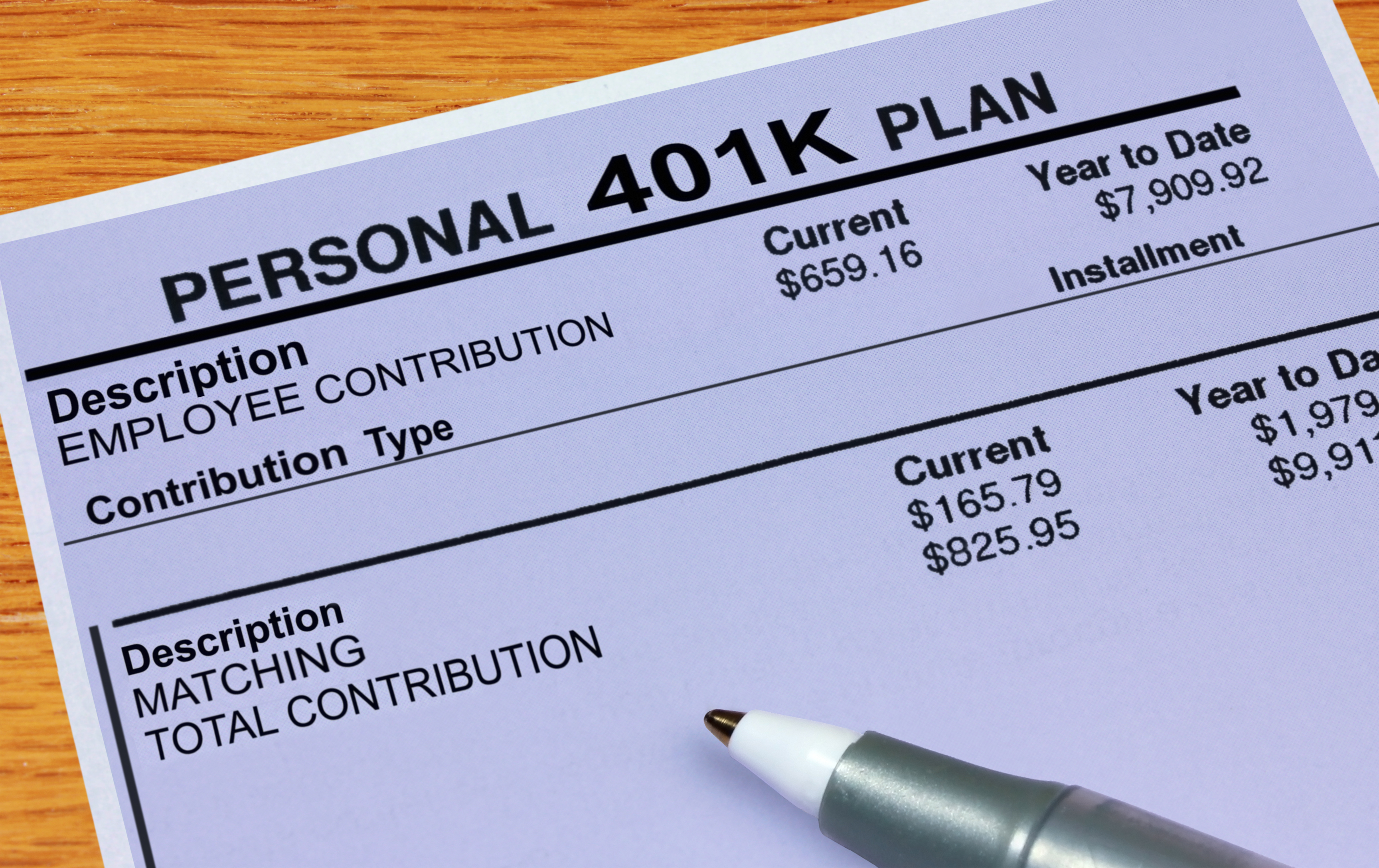

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. When you take a distribution from your 401 k your retirement plan will send you a Form 1099-R.

To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation. If you are under 59 12 you may also. Assume the 401 k in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Use this calculator to estimate how much in taxes you could owe if you take a. Lets go back to the 401k calculator.

Strong Retirement Benefits Help You Attract Retain Talent. Our free 401 k Distribution Calculator helps you to determine your withdrawal amount and where you stand with your 401k or IRA account. So if you withdraw the 10000 in your 401 k at age 40 you may get only.

The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement. We have the SARS tax rates tables. Please visit our 401K Calculator for more information about.

What Is The 401 K Tax Rate For Withdrawals Smartasset

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Simple 401k Calculator Online Shopping 43 Off Aarav Co

Free 401k Calculator For Excel Calculate Your 401k Savings

Traditional Vs Roth Ira Calculator

401k Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

401k Calculator With Match Clearance 57 Off Www Alforja Cat

Retirement Withdrawal Calculator For Excel

Tax Calculator Estimate Your Income Tax For 2022 Free

401k Calculator Sale Save 41 Srsconsultinginc Com

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

-savings-detailed.png)

401k Calculator Sale Save 41 Srsconsultinginc Com

Traditional Vs Roth Ira Calculator

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

Free 401k Calculator For Excel Calculate Your 401k Savings

Retirement Withdrawal Calculator For Excel